Appraisal Errors – Examples

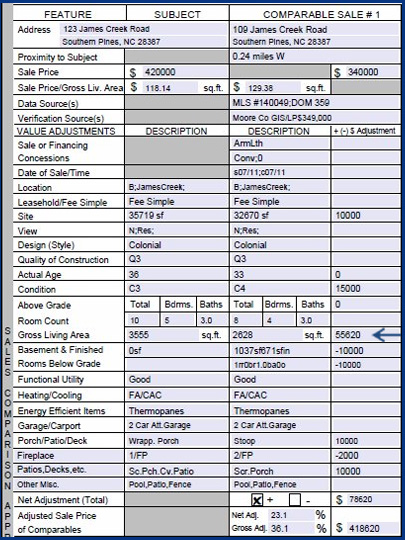

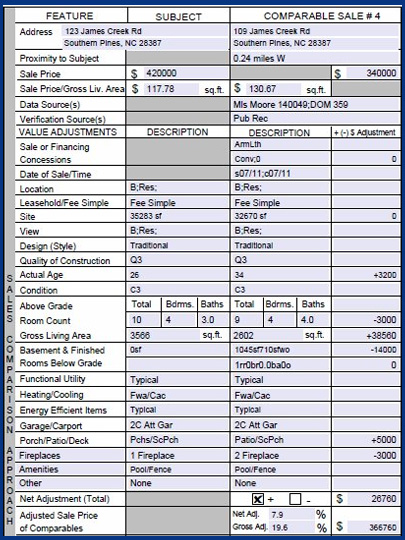

Which square footage total is right? 2,628 or 2,602. What about the square footage adjustment? $55,620 or $38,560? What about the bathrooms? Are there 3 or 4 bathrooms? Same comp – different info.

What about the age of the subject property? One appraisal says it’s 36 years old and the next one shows 26 years old… For the same comp, one appraisal has a zero adjustment and one has a $3,200 adjustment. I guess the age fairy decided that for every year the house declines in value $400.00, regardless of who lives there or what condition it’s in.

Same comparable sale; two different appraisers; two totally different adjusted values; who is right? In this case, perhaps neither one…

What about the size of the lot? One appraisal says 35,719 sf and the other says 35,283 sf. One appraisal has a $10,000 adjustment for a lot just a few doors away. How do you determine that adjustment?

Who’s on first – who cares? Too many appraisers are so consumed by fear, worrying about new unrealistic underwriting guidelines, they have gotten away from doing the things that make appraisers worthwhile. Appraisers are supposed to give an unbiased, local opinion of market value. That’s why they are hired (at least that’s why they used to get hired). But now, no one really wants their opinion. They just want a form that fits the percentage guidlines and gets through underwriting. No one cares about the true property value and the honest opinion of a trained, local expert. It’s all about fitting the form. Sound familiar?

That was what got us in trouble in the first place. So, what has the HVCC done for consumer protection? Zero, nada, not a thing. It’s time to go back to common sense appraising and underwriting. Buyers and sellers just want to complete their transaction and get excited about their new homes. All this BS makes no difference. Let consumers back into the home buying game and get overzealous underwiting and percentage guidelines out of the way. Real estate valuation will never be a perfect science and a computer can’t price a house accurately. Give appraisers back their independence. The system is not perfect. But, it’s a million miles ahead of computer valuation services and percentage guidelines, which have turned into steadfast rules, not the guidelines they were meant to be.

While appraisals are always, in part, based on opinion, always check every appraisal for errors if there is any question about the final value. Question everything…

Sometimes in the appraisal business, “it depends” applies. Make sure your appraisal is done by a local, experienced appraiser, especially if your home is not the cookie cutter style with a hundred others just like it, and within a one mile radius.