AVM’s & Home Valuation The Easy Way – NOT the Right Way!

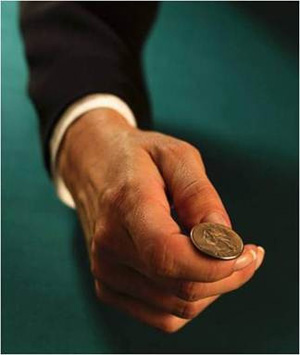

When it comes to pricing your home, using a computer valuation service is about as reliable as flipping a coin. There is no magic formula, or latest and greatest technology that allows any computer to calculate a home’s value. Real estate is a people business and values are influenced by people’s motivations and circumstances. In Realsville, USA, home prices can only be determined by a living, breathing, local real estate expert. Don’t fall for the hype. The facts are: Automated Valuation Models provide inaccurate home values more than they do accurate home prices. After ten years of study and analysis, regardless of any new software or designs they come up with, the same problems keep killing the system. No matter how good the computer program is, if it uses wrong data to calculate home values, it can only put out bad info, based on the bad info that goes in from the local assessor’s office. As long as they rely on public records, AVM’s will continue to mislead consumers and help them lose money when buying or selling real estate.

The use of automated valuation services has skyrocketed over the past five years. As the discussions between big banking and the GSE’s has fueled the demand for computerized valuation products. Even the government is touting the improvement in quality of the computerized valuation services. If Fannie Mae and Freddie Mac think these services are okay, what should the public think? They trust the hype. No matter how many studies AVM’s come up with that show their so-called quality of valuations, as compared to appraisals or closed sales in a given market area, there’s a very good chance the numbers are being created by someone with a stake in the outcome. If you’re trying to sell a product, you are going to make the numbers look as bright as possible. it’s almost like entering a new listing in MLS, you want to paint a picture for the potential buyers. The hard facts that would be nice to know when oit comes time to do actual comparisons with othjer properties, that pretty painted picture, doess little to describe the actual prodcut that trtansferred at closing. It is a marketing tool and no agent is going to spell out he home’s flaws when they are trying to attract a buyer. Updated baths could mean the pink fixtures were replaced with new gold ones; or one of a million other possibilites where one persons visualization of updated or improved foes not eqyal that of another. Much like the valuation process itself, it can be very subjective.

No matter how good the numbers show for an improvement in automated valuation products, we can go in any appraisers offie in any town, in any state; and within 30 minutes we can prove to you the amount of errors between the square footage detauils in the MLS, punlic records, and the differences in the square footage totals as calculated by a licensed appraiser. Substitute each number for another and the value of the property changes by thousands, or even tens of thousands. the evidence is there, if anyone wannts to see it. but, that’s the problem. No one really wants to know. Let’s sweep that under the rug. we have enough troubles right now. Maybe we’ll come cack and look at this issue later. But, later never comes and the problems continue to grow. Please don’t take my word for it. ask appraisers in your town. Most can tell you stories and the inaccuracies between what they personally measure, what’s listed in the MLS, and what is reported within the local tax department. Often theree totally different numbers. plug any one of those numbers in a CMA and the magic price-per-square-foot formula and the whole premise of the AVM is flawed. What started with surely good intentions, was doomed from the very beginning. As we start to hear more talk about the quality of automated valuation models improving all the time, based on comparing their values with actual sold prices, is nothing more than big lenders making the numbers say what they want them to say. In this upside down real estate market, reading numbers and determining national averages is a lot like flipping a coin, where one guestimate is as good as another.

Out of millions of homes and sold prices, no matter if you picked a number out of a hat, you would have to get some right (has anybody bothered to check the county tax assessor’s numbers against sold prices?). Getting some home prices close to the actual selling prices, doesn’t mean you have any great wisdom or knowledge that others are missing. Or, that you are the only person on earth who figured out a better way to calculate home values and can sell it for 90% less than any competition. It means that with enough homes and values, you have to be right sometimes. I don’t know about the origin of the AVM, but do know they have been around since the beginning of the internet explosion. They earned a very small slice of the business pie and have been used by lenders when the accuracy of the home value was not quite so important. If they had a customer that is holding a few million in CDs in their main office, and they wanted to borrow 50% on a $200,000 house, it’s probably pretty safe to give them a loan without an appraisal at all. The AVM’s were generally used for loans where the customer was already approved, based on the customer, not the collateral. The local bank didn’t really need an official valuation number, but were required by some government regulation or secondary mortgage guideline, to say they have a professional “valuation product” in the file.

AVM’s made up about 5% of the total appraisal ordering market (now over 85%). Interestingly, if you look at the values provided by the county tax departments across the country (remembering that with such large amounts of numbers you have to be right sometimes), the local assessor is often just as accurate (if not more so) than the fancy AVMs. Big Banks helped to create this illusion of AVM’s providing a “technology based” service; simply so they could sell a product. It makes a great ad, but the product is similar to a 30-day magic diet pill, where you can eat all you want and still lose weight. When something sounds too good to be true, it generally is. Such is the case with many Automated Valuation Models. If lenders truly want to use an automated valuation product that served the purposes of protecting the mortgage investors in “special circumstance” loans, the public records system is there and already paid for; by our tax dollars. On a national basis, it’s just as accurate as any AVM, if not more so. The local tax assessor also has another advantage in determining property prices, because they have actually seen the house in person. But, where’s the fun (profit) in that?

The growth of the AVM industry is a byproduct of the Golden Rule. For those customers that really don’t need appraisals (for loan security) but banks have to have some number/form in their files, AVM’s can be a great product and are a great new profit maker. Some business owner said “We’ll put this info in a shiny new package, make ads that use the word appraisal, and convince customers to believe these products are continually improving (as technology gets better); we’ll make a killing.” Between AVM’s and AMC’s, banking profits continue to soar during the worst real estate market since the Great depression. No talk about “usual and customary fees” in the lending business!

I had lunch with a local lender about a year ago, that told me his company would access eight to ten valuation models on each loan (most for free and some for a few dollars per home) and take an average of the totals. It was an inside joke between the branch managers, that out of these 8-10 “automated valuations,” most of them were not worth the paper they were printed on. But, the bank charged each customer a $119.95 “ITV” (Internet Technology Valuation) or “IVP” (Internet Valuation Profile,” or some similar name, and it was a pure profit maker; “just make the borrowers trust it” were their instructions. On a closing statement, it was not an amount high enough to draw much attention; but, add that fee on top of every loan written and we are talking about some serious profits.

The real problems with AVM’ starts with the information they use in their calculations. The square footage fairy does NOT work at the tax department. Stop, think, and repeat that statement. The tax department doesn’t have some secret square footage staff or any method to create precise square footage details. It’s not their concern. The tax department has no interest in providing the real estate industry with the information they need to do their jobs properly. The square footage information in the tax department was NEVER designed and/or intended to be used outside of the tax office. The assessor’s office will be the first to tell you NOT to rely on their square footage data when calculating home values.

They do NOT measure houses precisely (never entering the home) and don’t even have any nationally mandated methods for how they come up with the square footage totals, or what names they put on it (i.e. heated, GFLA, EstLvAr, SgFF, TlLivSF, Heated, TotSF, or one of a hundred others). The square footage totals are frequently wrong and it’s easy to see the errors if anyone cares to look. After all, it’s not really an error from the tax department’s perspective.

The AVM’s will argue that the square footage total is not that big of a deal and that their value averages are still reliable; “the square footage totals are close enough.” Guess what? They are not! In a large percentage of homes in different size markets all across the country, they are flat out wrong. My own parent’s home has over 4,400 sqft on the tax record. The house has about 2,800 sqft and a 700 sqft basement. Using the AVM’s magic price-per-square-foot formula, try it with 4,400 sqft; then try it with 2,800. Slight difference! And, these 500 to 2,000 sqft errors in tax records are much more common that you might think. But, no one is talking and no one is watching. The banks are calling all the shots and this is one secret no one plans to let out of the bag. They don’t want to let the public know how inaccurate these products are; there’s just too much money to be made in the future. So, the fleecing continues…

Take these sqft errors and add them to any formula, no matter how complex; putting wrong numbers in any formula, puts wrong numbers coming out. It’s just the facts of life. The whole lending/appraisal/home valuation system is seriously flawed and consumers are being misled (again), and basically cheated out of their hard-to-come-by money these days. Consumers are paying fees for products that serve no purpose in the loan process other than to increase bank profits. The only valuation consumers care about is the one their lender tells them to.

Unless AVM’s are used for fun (just to check out your neighbors or your boss’s property), they are NOT something upon which you want to trust your largest financial investment. Don’t believe for a minute, that any lender would loan their money based solely on what these paper valuations say if they are not 99.9% sure about the customer, without real concern for the collateral. If they did, they wouldn’t be in business long. But, these charges will remain on closing statements for years to come.

We continue to overlook these little flaws, because the banks make big profits. They spend a small fortune to convince lawmakers how AVM’s contribute to mortgage security. It truly is one of the greatest sales jobs of all time! Many banks are even talking about using these automated products in all loans and doing away with appraisers altogether (at least about 90%). Wonder who came up with that bright idea? Bet they will get a raise…

AVM’s are too good to be true, period. They use inaccurate information to calculate home prices. There are no shortcuts to quality. The accuracy of the square footage details do matter. It matters to AVM’s in every line, where their technology-based reports display the total that says “price-per-square-foot.” I keep repeating “you can’t have it both ways” and it’s so true. It the square footage numbers don’t influence home values, then why base every home value on a price-per-square-foot formula?

It’s a brilliant sales job and just the way our system works. It is a perfect example of the Golden Rule in full force in America today; always follow the money. Behind the money is where you will find the true motivation. Looking out for the consumer’s best interest, and all the big talk of protecting home buyers and sellers, is just talk for the commercials. Buy the latest diet pill – sell a home based on the value provided by an AVM; either way, you will NOT be happy with the results.